Having covered Web3 for almost a year, I should have known that “crypto,” “DAO,” “DeFi,” “blockchain” and other terms associated with the future of the Internet sound, for most people, like a mosquito stuck in each ear. But I’m a slow learner.

Slumped in our muggy kitchen, listless and drunk after a day of July Fourth debauchery, my girlfriend locked eyes with me as if struck by a brilliant idea. I expected her to begin crushing potato chips into our Annie’s Mac & Cheese, or suggest we use the leftover pasta-water for a couple’s foot soak––two possibilities I would have fully supported. Instead, she sprayed the equivalent of OFF! for people who know (way) too much about NFTs.

“I am not your ‘Metaverse’ person, okay?” she declared. “I need you to know that.” She looked relieved, while I tried my darndest to avoid saying the wrong thing: I was actually talking about Web3, not the metaverse…

I was unsuccessful.

My girlfriend’s reaction is less about me (I hope) than about two years of buzzy headlines: “Buying Land In The Metaverse Isn’t Cheap”; “FBI Adds “Cryptoqueen” to Ten Most Wanted Fugitives List”; ”No One Is Buying Chris Brown’s NFT Collection.”

So bear with me, because this is about Web3: that vague descriptor of early-stage experiments and theories stemming from a collective desire from techies to define the next computer paradigm (or not).

But it’s also not about Web3.

Before we delve in, I want to say one thing.

In imagining this new paradigm and what it might do to and for our world, we’re taking part in a crucial task. Collectively, we’re unveiling what’s cracked and broken in society now––today. The more we look to the future, I believe, the more inequity we’ll reveal, as if staring deeper into a huge (theoretical) mirror.

After chatting with a plethora of Web3 experts, I began to see a reflection of our current world––and all the things in need of fixing.

Web3 isn’t definable as of yet (I suggest applying air quotes at every mention), but its preferred future, according to lots of tech bros, is based in decentralization, a peer-to-peer network that operates without a central authority figure.

Rather than accessing the Internet through services run by companies like Google or Meta, you would actually own and govern sections of the Internet. Instead of logging into different platforms with different usernames, you would need only one username (or digital persona), with the ability to create anything, no permission needed.

Think of a commune or co-op––a really, really big one.

To ensure that Web3 doesn’t follow the same path as Web2 (the current iteration of the Internet in which people’s time and content is converted into the wealth of businesses and massive corporations), crypto and blockchain technologies will supposedly return the control and ownership of data to individual users via a network of computers that publicly track all transactions.

In other words, in Web3, social platforms, digital marketplaces and search engines will be owned by the collective, not the cult leaders––power to the people!

But alas: Crypto markets are currently collapsing, and the industry is already concentrated amongst a small group of players, whether it’s the top five Bitcoin owners or the Web3 developer interface called Alchemy that’s valued at over $10 billion.

Many critics have also raised important questions about––go figure––regulation: Who will pay for global data centers? Who will ban offensive accounts? Who will help folks reset their password when they forget?

“Running a global business on this scale requires an inescapable amount of centralization just by the brute fact of having to exist and interact with the rest of the civilization,” writes Stephen Diehl, one of Web3’s most ardent critics.

So, while a purely decentralized web may be a pipedream, our desire for such a thing couldn’t be more real.

Why? Simple: We’ve experienced 20 years of predatory data harvesting and subsequent manipulation from big tech companies who have our names, our emails, our phone numbers, our locations––who know our devices and what we’re doing on them at all times. Free online perusing has come with a cost: Our data has been collected, sold and leaked. All without the courtesy of a well-deserved apology. (And no, none of Mark Zuckerberg’s apologies count.)

Because of this, Diehl thinks decentralization is nothing but an ambiguous term fueling “the dangerous idea that technology can fix social problems.”

“The intellectual siren song of crypto that seduces clever people whispers in your ear that no matter what problem you see in the world, a magical coin is going to disrupt human power relations and rearrange the world to your liking,” Diehl writes. “And it’s a siren song many people can’t resist.”

Perhaps the loudest Web3 siren is Chris Dixon, general partner at venture capital firm Andreessen Horowitz, which notoriously doubled its Web3 investor fund to $4.5 billion in May.

Dixon doesn’t think decentralization is “a silver bullet” exactly, but a way for “participants to work together toward a common goal––the growth of the network and the appreciation of the token.”

With the proliferation of tokens like Bitcoin, Dixon has said that tech giants may eventually be replaced by a multitude of smaller businesses.

“We have the ability for creative people, businesses, and startups to reach audiences directly, and to truly have a relationship with those audiences that is not mediated by algorithms and advertising, which is where I think we are today,” said Dixon in an interview with The Verge.

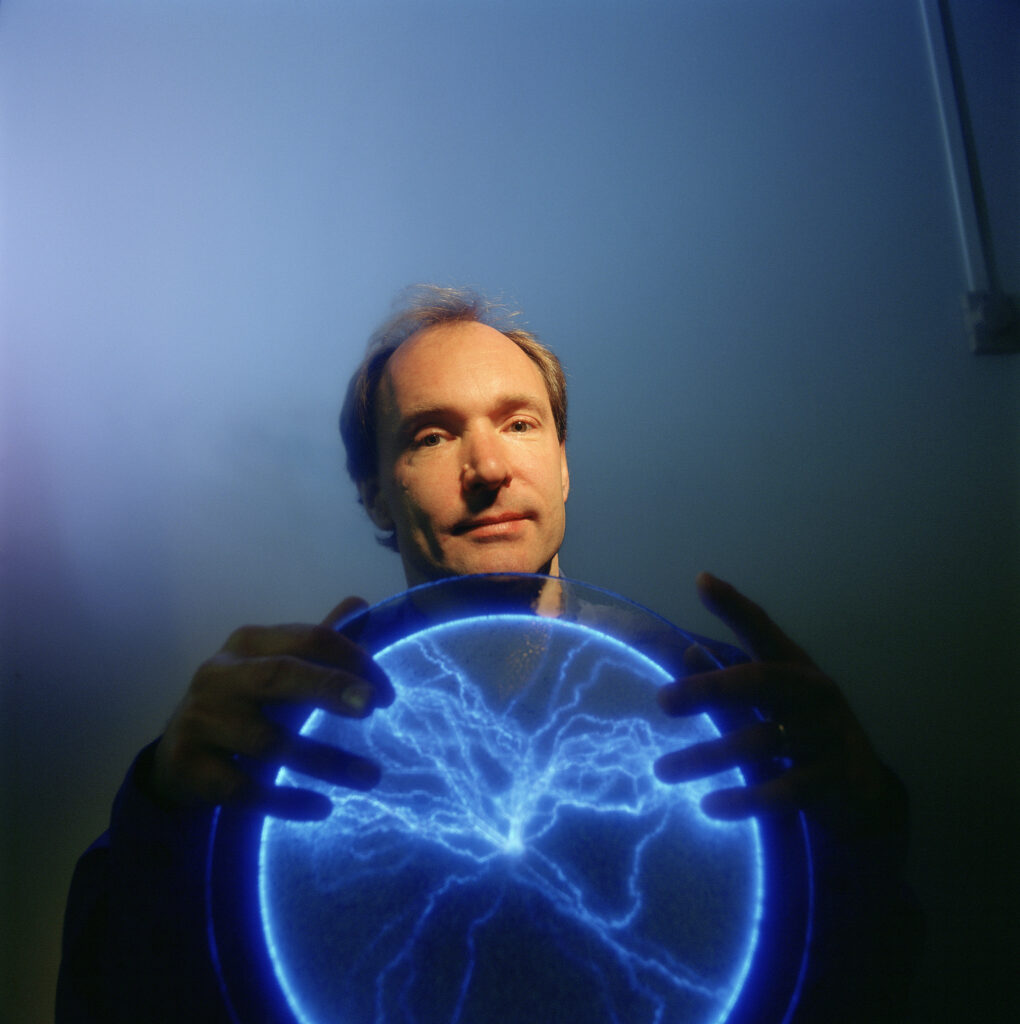

Amidst this ongoing debate, one Web3 (remember those air quotes) project that caught my attention is being developed by Tim Berners-Lee, the inventor of the World Wide Web. Because Solid is an open-standard––not a company––it’s ineligible for monopoly status. What it does is invites people to store their data in personal web servers called Pods, or decentralized data stores.

With Solid, third-party apps (any app made by someone other than the manufacturer of a mobile device or its operating system, like a photo-editing app for Instagram posts) can still replicate the data users share with them, but those users are able to choose exactly what that data is.

It doesn’t sound like a huge improvement, but without overarching regulation, it’s a logical step toward what advertising strategist Renny Gleeson thinks is both a realistic and utopian outcome of a better Internet: “the ability for normal humans to be able to have control over their data and share that data in ways that benefits them when they choose.”

Diehl also finds the concept behind Solid to be, well, solid, but strongly believes that Web3 is “not the golden path that leads us to that world, it’s the same old crypto bullshit just packaged up in a sugar pill to make it easier to digest.”

Then there is Twitter co-founder Jack Dorsey, who is already thinking beyond Web3, tweeting last December that “The VCs [venture capitalists] and their LPs [limited partners, or undisclosed financial backers]” are the true owners of the space. “It will never escape their incentives,” he typed. “It’s ultimately a centralised entity with a different label.”

Dorsey followed up with an announcement of web5 (serious air quotes—I mean, what happened to 4 for a start?), his new developer platform run on Bitcoin and decentralized finance. “This will likely be our most important contribution to the internet,” he tweeted in June.

When I asked venture capitalist and author of The Metaverse: And How It Will Revolutionize Everything, Matthew Ball, what he thought of “”””web5””””, he told me that we shouldn’t get stuck in the centralized-versus-decentralized binary: “It’s a continuum, and we tend to believe that the extremes on both sides are sub-optimal.”

“I think what Jack is speaking to,” Ball added, “is really just more of an examination of where centralization has merit and where it doesn’t.”

I was therefore left to wonder about merit, and whether I should trust Dorsey with my future, a guy who for 10 years ran a massive communications platform that avoided the same issues he’s choosing to tackle now (“a delightful user experience?” Where was that on Twitter?).

Another issue with crypto’s decentralized model is that it’s a major target for scams. Certik just reported that Web3 projects have already lost $2 billion from hacks in 2022 alone, featuring the infamous scandal in which Ronin Network was taken for $625 million. Worse yet, there’s a comical lack of customer support. When your crypto wallet is “drained”––which one person told me was “inevitable”––there is nowhere to turn. No one to call. No idea whether or not the hacker still has access to your account. And good luck reporting your stolen Ethereum to the IRS!

Maybe the scams and hacks are just growing pains of a young industry. Maybe they even shine a light on the same issues some folks have been facing for centuries. Cleve Mesidor, executive director of The Blockchain Foundation, told me that the riskiest market for people of color (some of whom are the highest adopters of crypto in the U.S.) isn’t crypto—it’s the status quo.

“Traditional markets and traditional banking have failed us all equally,” she said, whether it’s the unbanked, Black business owners or Latino nonprofits. “I have an advanced degree; I make good money. But they still give me subprime loans. Money managers don’t target me.”

Mesidor made a similar point about the environmental debate surrounding crypto mining.

A single bitcoin transaction uses the same amount of power that the average American household consumes in a month! I exclaimed, frantic. Mesidor called bullshit––not on the facts, but the concept as a whole––stating that communities of color, and women, already face the brunt of environmental impact.

“If people (government officials, I presume) blaming proof-of-work bitcoin mining want to address the real problems, they would look at sustainable goals and industries with big lobbyists that they give passes to,” Mesidor said. “This is not about giving crypto mining a pass. It’s about why we’re not solving the problems we already have.”

Mesidor made me think about the Supreme Court’s recent decision to strip the EPA’s authority to effectively curb carbon emissions in the U.S.

Negligence aside, crypto is taking a massive hit right now. Bitcoin just reported its biggest monthly loss in 11 years, and major crypto companies (3AC, Celsius, Voyager Digital) are laying off hundreds and/or filing for bankruptcy. But Mesidor isn’t worried.

She believes that crypto––“the future frontier”––will rebound to a $3 trillion market “rather quickly,” shedding unworthy projects along the way.

“The problem is that the space is not sustainable,” she told me, referencing a misguided focus on opulence and wealth, with many projects simply seeking to get rich quick.

“I’m not concerned if this industry is a bubble, if it’s going to break or if it’s going to become too big, because in the blind spot of the industry are the people at the grassroots who are building products and services to tackle inequity.”

Sustainability could be a crucial decider of Web3’s future. Which projects matter (or will matter) to people? Which projects provide a worthy and easily explainable utility for consumers?

Two examples Mesidor mentioned were Oak Coin ($OAK)–– “a community currency for the people of Oakland, California” that empowers locals via a pool of shared assets––and Guap Coin ($GUAP), which has over 10,000 wallet holders and aims to empower the economic voice of the Black community.

Even though the value of Guap Coin is at an all-time low (following the overall industry trend), it, like Solid Project and Oak Coin, presents a specific use case that makes sense for certain consumers and could potentially address issues of inequality.

Mary Spio, a rocket scientist and founder of a blockchain music-based streaming platform called CEEK VR, also thinks more use cases are needed to boost the Web3 space. “There’s such a huge content gap,” she told me. “If we cannot fill that fast enough, I think we are going to face challenges as an industry.”

While Spio’s platform produces realistic virtual concert experiences with the likes of Lady Gaga and Ziggy Marley (CEEK is partnered with Universal; bye-bye “decentralization”), it also gives lesser-known creators––artists, musicians, gamers, etc.––the ability to upload their content, engage their fans directly and profit off of digital assets they’ve made using CEEK VR’s tools.

This is the creator economy model that represents another bone in the back of Web3. After giving our data and content away to mega-platforms and organizations on Web2, people now want to benefit alongside emerging platforms, or upset institutions entirely.

In terms of music, I’m reminded of the time Deadmau5 attempted to redefine what the Recording Industry Association of America calls “going platinum.” Deadmau5 released a single in the form of 1 million cheap, easy-to-buy NFTs. Giant buses imprinted with a QR-code linking consumers to the $3 dollar download entered arts events across the country and helped consumers set up crypto wallets.

As ridiculous (and off-putting) as this sounds, it does pose an interesting alternative thought-experiment to artists relying on record labels and streaming platforms that make money off their music. And because the purchases are recorded on the blockchain, Deadmau5 can see who his fans are, offering him the chance to connect or offer up exclusive content and promos to future gigs.

“It is this neat mix of patronage, fandom and collecting that could not exist before,” Dixon told The Verge.

Unlike most cryptocurrencies as of late, CEEK VR’s coin has actually been increasing in value. “There’s a real utility and circular economy tied to it,” Spio said. “There’s a demand. I think that’s something most coins don’t have.” Spio explained that when a cryptocurrency has no obvious utility, it is built on hype, and therefore falls prey to the ebb and flow of the market.

“Ownership,” Spio told me, “is a hallmark of Web3.” And dare I say, the metaverse (which is different from Web3––sorry, y’all!).

The metaverse––which Matthew Ball told me is still “mostly hype” due to the lack of technology able to support “a persistent virtual and 3D simulation”––provides a new space for major platforms to emerge (Roblox, Fortnite, EPIC Games), brands to play around in (look up “Gucci Town” or “WimbleWorld”) and entertainment and education experiences to thrive.

The metaverse, however, also invites privacy horrors, the likes of which we’re just beginning to understand. According to a recent study at Rutgers, hackers can use VR headsets to record “subtle, speech-associated facial dynamics to steal sensitive information communicated via voice-command.” Zuckerberg’s pioneering involvement in the space doesn’t exactly ease my mind either, as his rebranded baby, Meta, sells VR hardware equipped with eye-tracking technology.

I’m worried that, in moving forward without proper education and regulation, our data will be up for grabs in different (even more invasive) ways than it is now.

Which is why so many people believe that, to build a successful metaverse, we must also build a “decentralized” web. In other words, Web3 must walk so the metaverse can run.

And getting back to trust: Can (or should) we actually trust our government to regulate all of this?

(With a Supreme Court so set on stripping us of our privacy “IRL,” I say no, but let’s entertain the idea, shall we?)

When I asked Matthew Ball if he thought technology is advancing faster than we’re able to control it, he turned instead to political inaction: “I think the bigger problem is that the senior-most officials in government do not seem to have a particularly robust understanding of the last 15 years, least of all the next.”

The Digital Services Act––a breakthrough piece of legislation passed in the European Union––addresses illegal and harmful content online, requiring tech companies to pay up to 6% of their global revenue (billions for the major platforms) if they don’t consistently monitor and remove it.

But these regulations don’t yet exist in the U.S.

Last December, a woman named Nina Jane Patel reported being “virtually raped” in Meta’s Horizon Worlds platform. After her avatar was touched and groped by a group of avatars with male voices, she told Refinery29 that trauma resulted from being “immersed.” “As my avatar, and I, entered this room and my avatar [was attacked], I was attacked.”

In the end, there are no laws in place to pursue a complaint.

Regardless of what new technology surfaces, there will always be people who strive to misuse and abuse it. So without proper regulation, more immersive experiences could make way for more disastrous abuse online.

When I asked Mesidor what would threaten the widespread adoption of crypto, she said Washington, which “wants to use policies from the 1930s to regulate crypto today in the 21st century.” Instead of attempting to transform crypto with traditional finance solutions, Mesidor thinks Washington needs to do “the hard work” in constructing a new path forward—including conversations around a financial literacy bill and implementation of a central bank digital currency (CBDC), which countries like Australia are already testing.

If the metaverse does actually become an interconnected virtual world within the next decade, we will need some serious regulation that doesn’t inhibit and prevent the goals of a decentralized web, but aids them.

One Web3 expert I spoke with coined the possibility of such enlightened regulation as a “Digital Bill of Rights” that helps require basic interoperability (in case major platforms don’t want to be compatible with the rest––lookin’ at you, Meta!). This way, users are granted equal access while moving between Web3 spaces, regardless of whether they want to share their data or not.

I can’t help but go back to the “blind spot” of the industry––those folks Mesidor mentioned at the grassroots level who are too concerned with sustainability, accessibility and inclusion to care about hype. These are the very people society often overlooks.

Still unsure of Web3’s impact or existence, I can at least acknowledge that people are in need of a new paradigm, something better than Web2 or Web1. So I’ll leave it at this: “Some of our best hope for the future is probably happening right now, though it may not look like it yet.” A friend told me this recently, and it made me smile. Even though our world’s reflection is looking pretty glum and, frankly, fucked up, I can see how, if tilted at the right angle, in the right light, Web3 appears to be born from hope.

Leave a comment